Over the last decade, there has been a tremendous change in how people use and buy the software. Starting from the early days of Salesforce to the increasingly growing SaaS ecosystem of 2021, customers have been demanding the consumerization of SaaS products.

With an increase in tech-savviness among the general audience, buyers are preferring to make the purchase decisions by self-educating themselves through an app/website rather than going through a sales cycle.

Due to a gradual accumulation of such factors, the responsibility of igniting the growth engine in any SaaS startup has shifted onto the shoulders of the product team. But devising and deploying a product-led strategy that’s scalable across dimensions isn’t a child’s play.

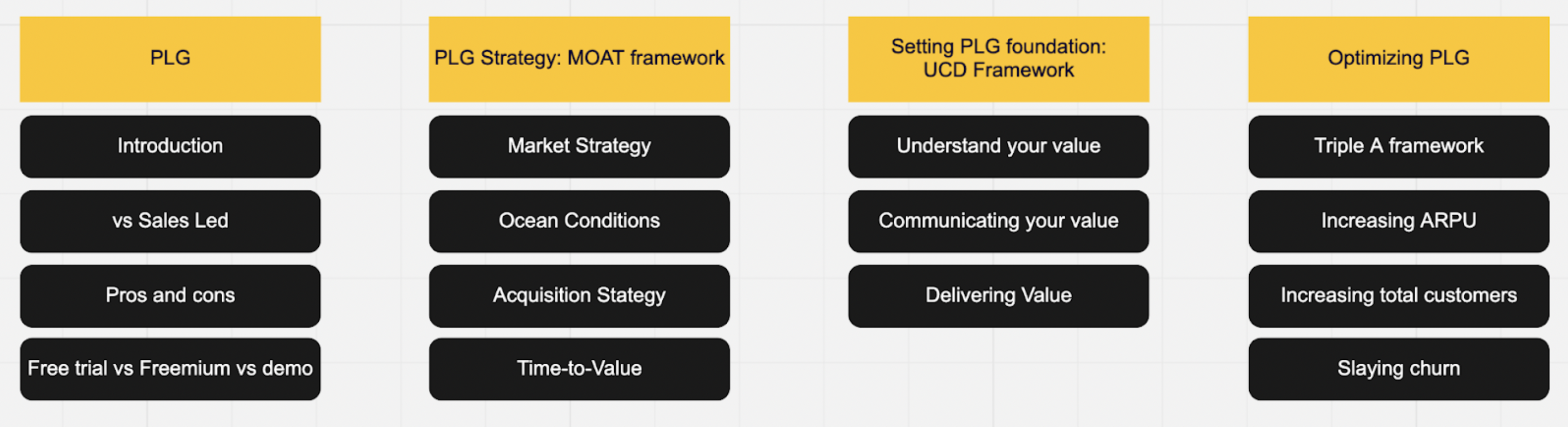

This squeezed-form blog post is a condensed collection of notes on the why, what, and how of Product-Led Growth (PLG) strategy, reformatted concisely into bullet points and diagrams for the reader to refer back for a quick refresher on any specific section.

What’s inside:

Introduction

For a SaaS business, there are three tidal waves/problems:

- Over the years, as the Customer Acquisition Cost (CAC) increases, the willingness to pay decreases.

- Buyers increasingly prefer to self-educate and try out the product themselves, versus going through a sales demo. (Reference)

- The product experience has become a part of the buying process.

GTM: How the company will target customers and achieve a competitive advantage. There are two major types of GTM – Sales-Led and Product-Led.

Sales-Led GTM (SLG)

The only way to sell is to talk to users.

Pros of SLG:

✅ High Lifetime Value (LTV)

✅ Perfect for niche and small Total Addressable Market (TAM), to build relationships

✅ Perfect for a new market that needs to be educated

Cons of SLG:

❌ High CAC -> pushes LTV -> increases price

❌ Leaky acquisition -> Only 2% of marketing qualified leads (MQLs)

❌ Organisation structure product innovation

❌ In SLG your primary Annual Contract Value (ACV) customers will drive the product and company

❌ In SLG, Sales marketing and success teams operate in parallel with the product team

In short, SLG would most likely fail in a SaaS setup, considering the above three tidal waves.

Product-Led GTM (PLG)

The Product team drives sales, marketing, and success.

In PLG:

😇 Marketing: Product is the lead magnet

👜 Sales: Product helps people understand our value

💯 Success: Product helps customers be independent

🔧 Engineering: Product minimizes time to value

Pros of PLG:

- Easily Scalable

– Wider top of the funnel with freemium, etc.

– Easy vertical and horizontal expansion, especially global - Low CAC

– High time to value, fast sales

– High RPE – Revenue per employee - Better UX

In short, PLG tackles all three SaaS tidal waves.

Setting up the PLG strategy

There are three top sales strategies:

- Free trial: A portion of the product or the complete product offered free for a limited time

- Freemium: Partial access to the product for an unlimited time

- Demo: Sales-driven walkthrough of the product

MOAT framework to decide the sales strategy

M — Market strategy: Is the GTM strategy dominant, disruptive, or differentiated?

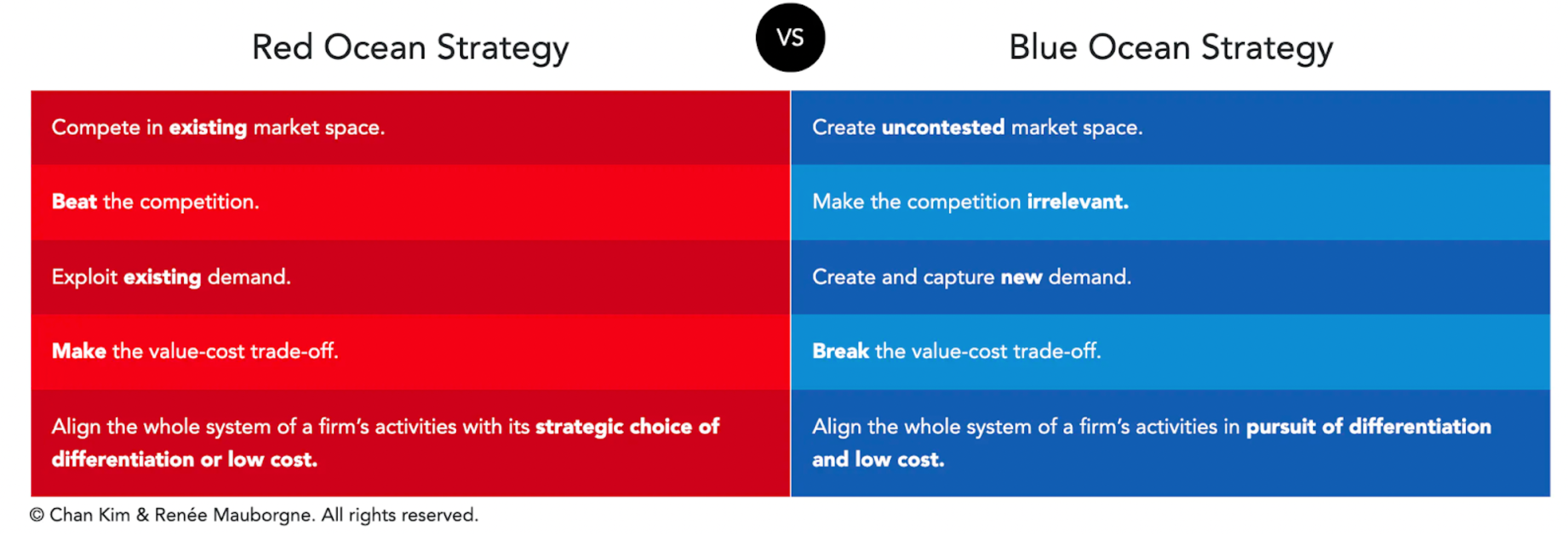

O — Ocean conditions: Red Ocean or Blue Ocean business?

A — Acquisition: Top-down or bottom-up marketing strategy?

T — Time-to-value: How fast can you showcase value?

M: Market strategy

1. Dominant: Do better, charge less.

Examples- Netflix, Uber

🌟 Freemium is ideal: Control the sizeable chunk of the TAM, convert it into paid in large volumes.

😬 Free trial is also okay: Convert trial users quickly. It’s okay to shed off a market segment as well.

Checkboxes for dominant:

☑️ Is the TAM big enough?

☑️ Does the product do the job better and cheaper?

☑️ Are the time and effort to value low?

☑️ Do you want to capture a majority of the TAM?

2. Differential: Pick a niche, nail it.

🌟 Both free trial and demo work well because of fewer market alternatives and low time-to-convert

💸 Can charge a high premium

Checkboxes for differential:

☑️ Is the TAM underserved?

☑️ Can you afford a high ACV to support the sales team or have a superior free trial experience?

3. Disruptive: Cater some use cases of an overserved TAM and sell cheap.

Examples – Canva for Adobe Photoshop’s market

🌟 Freemium model works best: It lets the customers try out the product, validate their use cases, and compare the alternatives themselves.

😬 Free trial can also apply: But it will have a less magnetic pull compared to freemium.

Checkboxes for disruptive:

☑️ Is the market full of overserved customers?

☑️ Is it a hyper-competitive market?

☑️ Is the TAM large enough for freemium?

☑️ Is freemium feasible?

O: Ocean conditions

🔴 Red Ocean companies: Outperform competitors to grab a greater share

🔵 Blue Ocean companies: Access an untapped market and create demand

🔵 Blue Ocean products:

- Lots of learning.

- Have to educate users: via sales teams or product-led sales.

- For a complex product: Use sales teams. Ex- Salesforce

- For a simple product and quick time-to-value: Use PLG. Example – Spotify

🔴 Red Ocean products:

- Easy to understand the market.

- Outperform competitors: Lower the CAC, widen the funnel, be leaner.

- Try to exhaust the market completely with PLG.

- Product-Led GTM is preferred because Sales-Led GTM doesn’t scale and is less lucrative in a blood bath of a market.

A: Acquisition

Bottom-Up or Top-Down. More on this here.

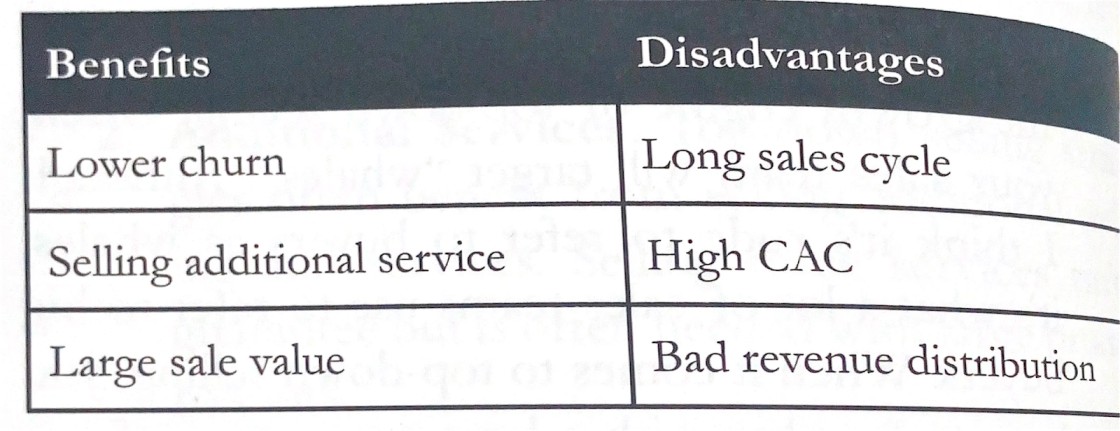

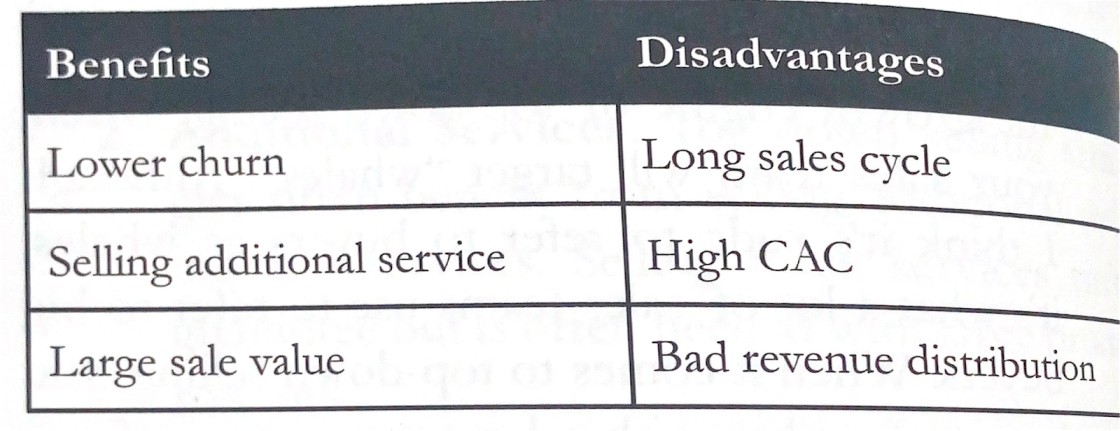

⏬ Top-Down:

- Target executives and key decision-makers

- One sale: Large company-wide roll-out

- Helps in achieving uniformity across the company

- Sales-Led model is preferred

⏫ Bottom-Up:

- Target frontline employees with freemiums and free trials and let them expand internally

- Quick adoption and low time-to-value

- Lower ACV: to let lower-level executives make purchase decisions

- Product-Led model is preferred

Benefits:

- Wide top of funnel

- Low CAC

- Faster sales cycle

- Predictable internal figures

- Diverse revenue sources

- Scalable

Disadvantages:

- Small ticket size

- Free customers

- Significant investment

- Expertise shortage

📊 Relevant trends:

- Earlier only top executives had the power to make purchasing decisions, nowadays that is shifting down

- With a flat team structure trending, impressing lower executives is enough to have the entire team discuss and adopt the product

Example- Slack

- Anyone can create a workspace

- Invite coworkers

- Let the trial exhaust and let the coworkers including top executives feel the need to upgrade

Which PLG model should be preferred for which Acquisition model?

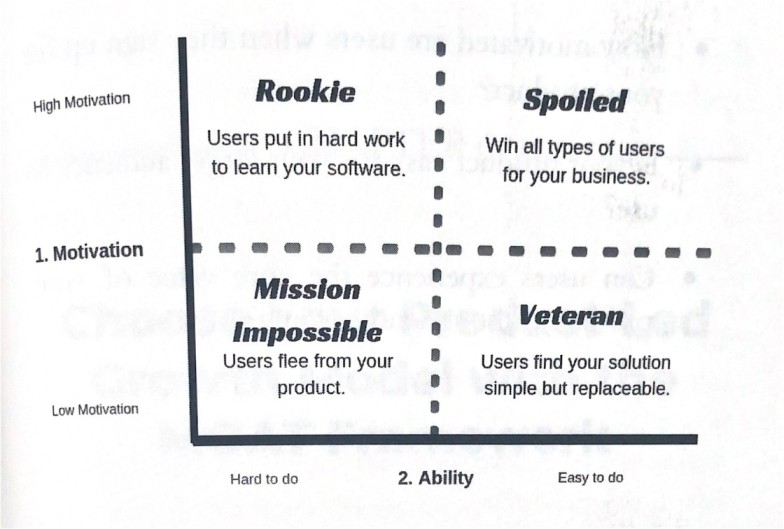

T: Time-to-value

New users should be able to experience the key outcome quickly and easily. More on this here.

Types of users:

To strengthen user motivation:

- Good copy, landing page, blog, content

To strengthen ability:

- Streamline onboarding

- Educate with coach marks, etc.

All of these 4 combined makes up the MOAT frameworks – M: Market Strategy O: Ocean conditions A: Audience T: Time to value

Food for thought: Can a hybrid model work?

Hybrid 1: Launch a new product in-house

Hybrid 2: Go freemium, give a trial for premium

Hybrid 3: Go free trial of premium, give freemium afterward

Building the PLG foundation

UCD framework:

- Understand your value

- Communicate the perceived value of your product

- Deliver on what you promise

U: Understand your value

Why do people buy products?

🔧 Functional Outcome: The jobs that users are able to perform

😁 Emotional Outcome: How customers want to or avoid feeling while using the product

😎 Social Outcome: How customers want to be perceived by others using the product

What are value metrics?

The way you measure the value exchange in your product. It acts as the bridge between your revenue and customer acquisition models. More on this here.

Two types of value metrics:

- Functional: Number of videos that you can upload, number of courses you can take, etc.

- Outcome: Number of views that your video will get, the revenue you will make using the product, etc.

A good value metric is

- Easy to understand: Helps the user decide within seconds on the pricing page, is driven by market practices

- Reflects the value received: Includes the core product components that lead to a meaningful outcome

- Grows with usage: Less usage – don’t charge more | More usage – don’t charge less

Use a data-driven approach to finding the right value metric:

- Find a metric that resonates with the usage of power users or high LTV users

- Prevent using metrics that resonate with churning users

C: Communicate your value

Ensure that your customer acquisition strategy drives revenue growth.

How to treat pricing and customer acquisition right:

❌ Don’t overcomplicate the pricing page: Users check out your pricing like a five-second test

❌ Don’t create a free plan with no incentive to upgrade: Tricky because offering key features makes it more lucrative and burns more resources

❌ Don’t create a free plan robust enough for the users to downgrade conveniently

Four common pricing strategies:

- Best judgement pricing: Driven by internal discussions

- Cost-plus pricing: Driven by the total cost incurred topped with a profit percentage

- Competitor-based pricing: Depends on market prices – not ideal for disruptive products

- Value-based pricing: Two ways to do that.

a. Economic Value Analysis (EVA):

Sum of all the outcomes – Functional outcome, Emotional, and Social. Take the sum of all three outcome-based prices and divide by 10 – the common assumption is to help customers make 10x than what they paid you.

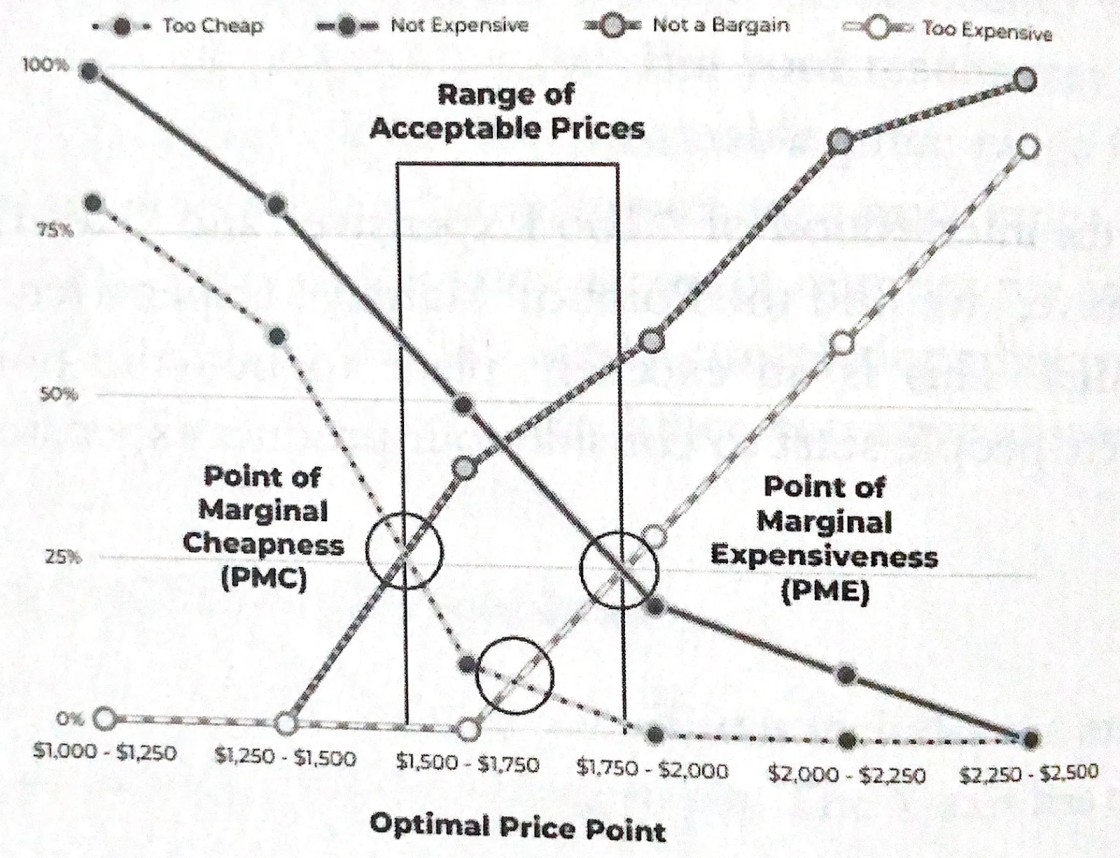

b. Market & consumer research:

Ask your customers how much price will be –

🤯 Too expensive: Won’t even give a thought

😅 Expensive: Have to think

😁 Bargain: A great deal

🤨 Too cheap: So inexpensive -> cheap quality

Ask users to categorize different prices into these 4 and find optimal the price:

Major elements of pricing page:

- Value metrics

- Willingness to pay

- Most-valued features

- Demographic info: Ex- what plan suits what business size

3 major types of value features:

👑 Leaders: Core features, included in all plans

🧑🤝🧑 Fillers: Some users need them, included in higher plans for ARPU (Average Revenue Per User)

👿 Bundle killers: Most of the users don’t care, included only in the highest plans

D: Delivering Value

Perceived value: What is communicated in marketing the product

Experienced value: What users get after using the product

Ideally, both should be equal but most companies struggle with it, thus creating an overall skepticism in the market.

Bigger the value gap – more churn, especially in freemium.

3 types of value gaps:

- Ability debt: When users fail to accomplish a key outcome. Ex- Promising a one-click landing page and eventually asking users to design it from scratch after signing up

- No clue why people are buying your products: You’ll either walk them through the entire product to let them understand the value or drive them to an irrelevant use case

- Not communicating the right value: If you bring the user thinking of X while your company does Y

Developing the PLG optimisation process

Triple-A Framework:

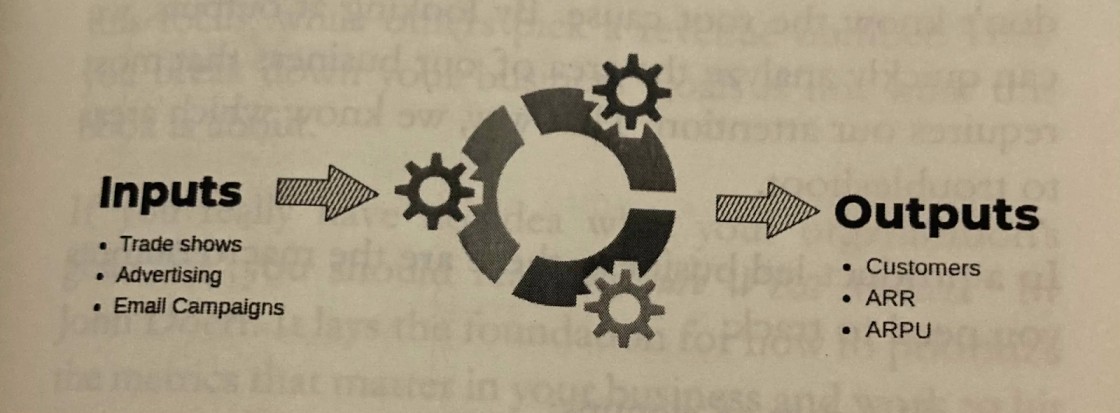

Analyze:

📥 Inputs: Resources put in for user acquisition and retention. Ex- Ads, Email campaigns, Onboarding flows, etc.

📤 Output: How does the input affect the product metrics. Output metrics should be macro enough to give a bigger idea of the business. Common ones- Signups, upgrades, ARPU, Churn, and ARR/MRR.

Measuring output for every input helps you in understanding what is working and what is not.

Ask:

🤔 Where do you want to go: What is your North Star metric and where do you want to take it?

🤔 Which levers can you pull to get it there: Three major focus areas.

- Reduce Churn

- Increase ARPU

- Increase number of customers

Find out changing which number brings in maximum ARR jump.

🤔 Which inputs to focus on:

Choose the ones that

- Creates maximum output

- Improves UCD processes

- Prioritise using ICE (impact, cost, and effort)

Act:

- Execute fast in a phased-out manner

- Focus on small wins/milestones

Optimizing the 3 main levers

- Increasing the total number of customers

- Increasing ARPU

- Slaying churn

1️⃣ Increasing the total number of customers

Bowling Alley Framework:

🎳 Bowling: Throwing the ball to knock maximum pins. The straighter the ball’s path the better. In the event of a bad throw, the ball goes into the side gutters. Similarly in a SaaS product, a streamlined onboarding process and few to no bad experiences prevent users from churning out.

😇 Bumper bowling: Installing multiple bumpers at multiple points on either side, to make sure that every throw hits at least one pin. Similarly in a SaaS product, we need to prevent churn by setting up multiple types of bumpers that nudge the user back on the right track.

🏁 2 major tasks:

- Develop straight lines

- Develop bumpers

Develop straight lines:

The shortest distance between the starting and ending points hit the maximum number of pins.

Help users understand the outcome in the easiest and least distracting way.

In SLG: ending point = purchase

In PLG: ending point = outcome

👉🏻 3 steps to develop straight lines:

a. Map out the path:

Revisit the onboarding journey like you are writing a tutorial – take a screenshot of each step and arrange them in order.

b. Label every step:

- Green: Absolute Necessary

- Yellow: Can be performed later

- Red: Can be removed.

c. Develop the straight line:

Rather than having a combination of Red, Yellow, and Green tasks, prioritize Green > Yellow > Red and try to push the desired outcome as early as possible. Keep the Greens, remove the Reds, and delay the Yellows.

Develop Bumpers:

There are two types of bumpers:

a. Product bumpers: Help users adopt the product themselves.

Ex-

- Welcome messages: Greet -> Communicate value and build trust -> Set expectations

- Product tours: Ask goal -> Take via shortcut [Show progress: ~4-5 steps]

- Progress bars: Prefilled %, realistically distributed

- Checklists: Only crucial steps, reduce complexity via milestones, employ Zeigarnik effect (tendency to not leave incomplete tasks) and Endowed progress (make them feel they are closer to completion)

- Onboarding tooltips: Help them decide the most valuable path, decrease their impact-less exploration

- Empty states: First-time states of different objects -> Prompt them to take action and create a FOMO of what it will be about

b. Conversational bumpers: Educate, set expectations, pull back, motivate to buy

Ex-

- Welcome email: Highest open rate, train for initial push, and set expectations

- Usage tips email: Tutorial of first steps

- Sales touch email: After users accomplish a milestone -> celebrate and ask for a query in reply/schedule a call

- Case study email: Adds validation just before they buy

- Better-life email: Nudge them to exhaust the benefits of the product

- Expiry-warning email: Set expectations, make it easy to pay, be available for help

- Customer welcome email: Reassure the decision -> Remind value -> Set Expectation

- Post-trial survey: Why didn’t you upgrade?

Three smart signals of conversational emails:

- Signup: Streamline them to quick win – Welcome and usage tips

- Quick win: Help them validate the desired outcome – Sales touch

- Convert: Upgrade while maintaining LTV

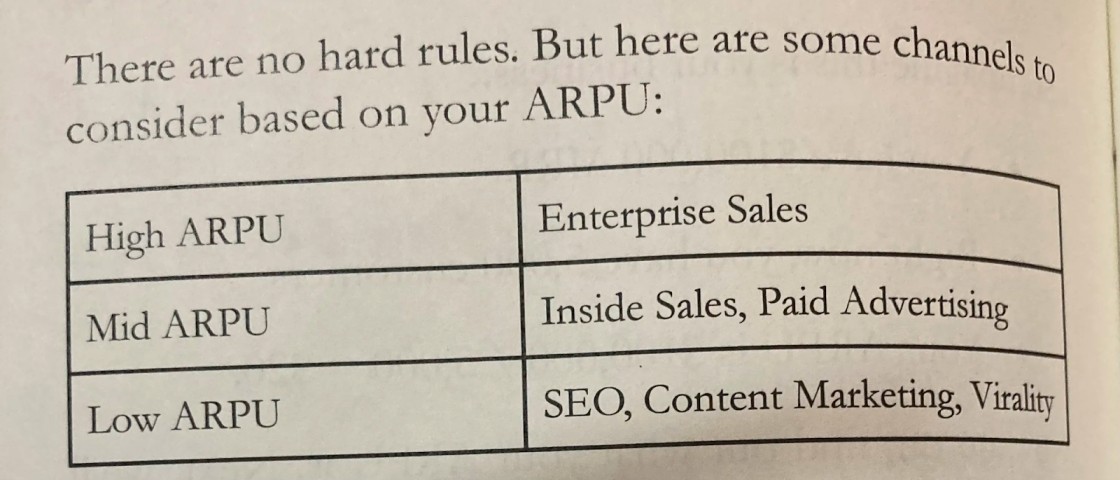

2️⃣ Increasing ARPU: MRR/# users

ARPU calculation:

- Vares from company-to-company, depending on whether you want to include free users in the calculation or not. In B2C it’s ideal to include the free users.

- ARPU defines your ideal customers, sales, and marketing strategy.

How to optimize ARPU:

- Use value metrics: Price the product in a balanced way according to price sensitivity, and limit the ideal features in the free trial

- Improve pricing tiers: Limited choices that fit everyone

- Increase prices: Check the price sensitivity graph to find the right price point of drop

- Upsell/cross-sell: Addons, services, or parallel products

3️⃣ Slay the Churn:

Three types of churn:

- Customer churn: (Churned Customers/total customers)*100

- Revenue churn: (Churned MRR/Total MRR)*100

- Activity churn:

- Define engagement: List critical actions that’ll reflect the willingness to continue using the product

- Start tracking: Make dashboards to check regularly

- Set weights to each action

- Define Ideal Score

- Focus on low score users

To analyze activity churn:

Rank users -> Rank customer accounts -> Calculate total score of the product (all users) -> Compare Cohorts -> Find correlations

To reduce churn:

- Measure churn metrics

- Set right expectations from the start

- Reduce ability debt

- Get usage feedback

- Reinstate value while repayment

- Run churn prevention campaigns

- Get maximum info on why a cancellation occurred

- Reduce delinquent churn

- Invest in customer success

- Fix the pricing

Conclusion

Over the course of this post, we skimmed through the basics of a product-led growth strategy and how one can implement the same in their business. Product-Led GTM in contrast to the Sales-Led approach is more scalable, easier, and faster to implement.

This post is inspired by @Vishant_Batta’s Twitter thread based on reading notes of the book - Product-Led Growth by Wes Bush.